NEW YORK--Out: smoky eyes, red lipstick and fake eyelashes. In: dewy skin, under-eye concealer, moisturized hands.

The $500 billion global beauty industry has almost overnight changed what and how it markets to a clientele hidden behind masks or stuck at home to avoid the spread of coronavirus. As consumers' social and travel plans have evaporated and work is conducted online, beauty brands have had to quickly redirect their pitches to show how their products are still relevant.

Companies are promoting make-up routines to look polished in videoconferences or virtual happy hours and positioning skincare as a soothing ritual that offers a quick respite from pandemic stresses.

The pivot has largely played out in social media campaigns, where companies can move more quickly, and not on television. Marketing from brands such as L'Oreal-owned Maybelline and Revlon Inc on Instagram, Facebook and YouTube now feature products suited for date nights over FaceTime, work-related video conference calls and Zoom happy hours.

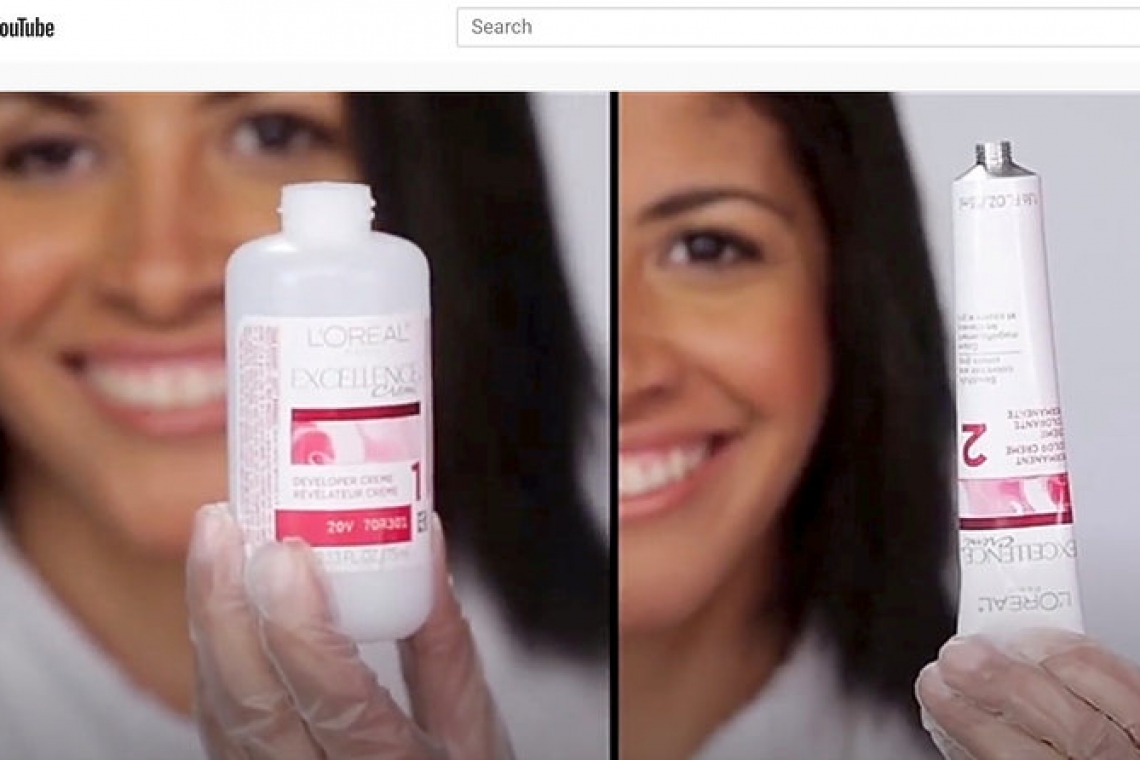

These ads play up products more in tune with the times such as skin and eye care products and home hair-colouring kits. "You don't have to wear makeup. But it helps," reads the tagline for makeup brand Revlon on recent Instagram posts, telling consumers they can still curl their eyelashes, "even if you can’t curl up to your special someone."

These posts have replaced TV spots from a few months ago such as one for Revlon’s long-wear foundation that featured a model walking to work and going to the gym. "Frequent washing doesn't have to result in dry and rough hands," said a Facebook ad for hand lotion from L'Oreal's Kiehl's line.

"You're doing your part by staying in, so we at Schwarzkopf want to help you feel like your best self at home," according to a paid post on Instagram from the at-home hair colouring brand owned by German conglomerate Henkel.

L'Oreal USA is taking marketing cues from consumer searches on Google and social media conversations, said Gretchen Saegh-Fleming, chief marketing officer of L'Oreal USA, a unit of L'Oreal Group, which owns Maybelline, hair care line Garnier and cosmetic brand Urban Decay. Consumers have been focusing on self-care products, stocking up on large-sized shampoo bottles, skincare and at-home hair coloring products, she said.

Total beauty sales in the United States declined 58% in the week ending March 28 versus the prior year, according to data from market research firm NPD Group. Courting homebound customers has been vital to protecting beauty industry bottom lines as other retail sectors collapse.

Global e-commerce sales at L'Oreal surged by more than 50% in the first quarter which helped partially offset a steep decline in retail sales at airports and department stores, the company reported on Thursday. Beauty sales have also started bouncing back in China, where the coronavirus outbreak began, and demand for skin and hair products are expected to rise.

Makeup marketing has focused on simple looks. L'Oreal's Lancome Paris brand on Friday hosted a live-streamed tutorial with celebrity makeup artist Lisa Eldridge.

The session concentrated on skin products like under-eye concealer and lip balm, versus pre-pandemic times when consumers might have been more focused on lipstick, Saegh-Fleming said. "People are taking an easier and fuss-free approach for their looks at home."

For cosmetic brands, lip colour will likely be less important as more people wear masks, said Agathe Guerrier, co-chief strategy officer for creative advertising agency TBWA, which counts Estee Lauder Companies Inc as a client in Spain. "One interesting thing will be how to make the best of your look and face while you're wearing a mask. This is something Asian countries have been used to for a while, and that's coming to the West," she said.