NEW YORK--A tiny hedge fund dealt a major blow to Exxon Mobil Corp on Wednesday, unseating at least two board members in a bid to force the company's leadership to reckon with the risk of failing to adjust its business strategy to match global efforts to combat climate change.

The success by hedge fund Engine No. 1 in its showdown with Exxon shocked an energy industry struggling to address growing investor concerns about global warming. It happened on the same day activists scored a big win against another oil major, Royal Dutch Shell - a Dutch court ordered the company to drastically deepen pledged cuts to greenhouse gas emissions.

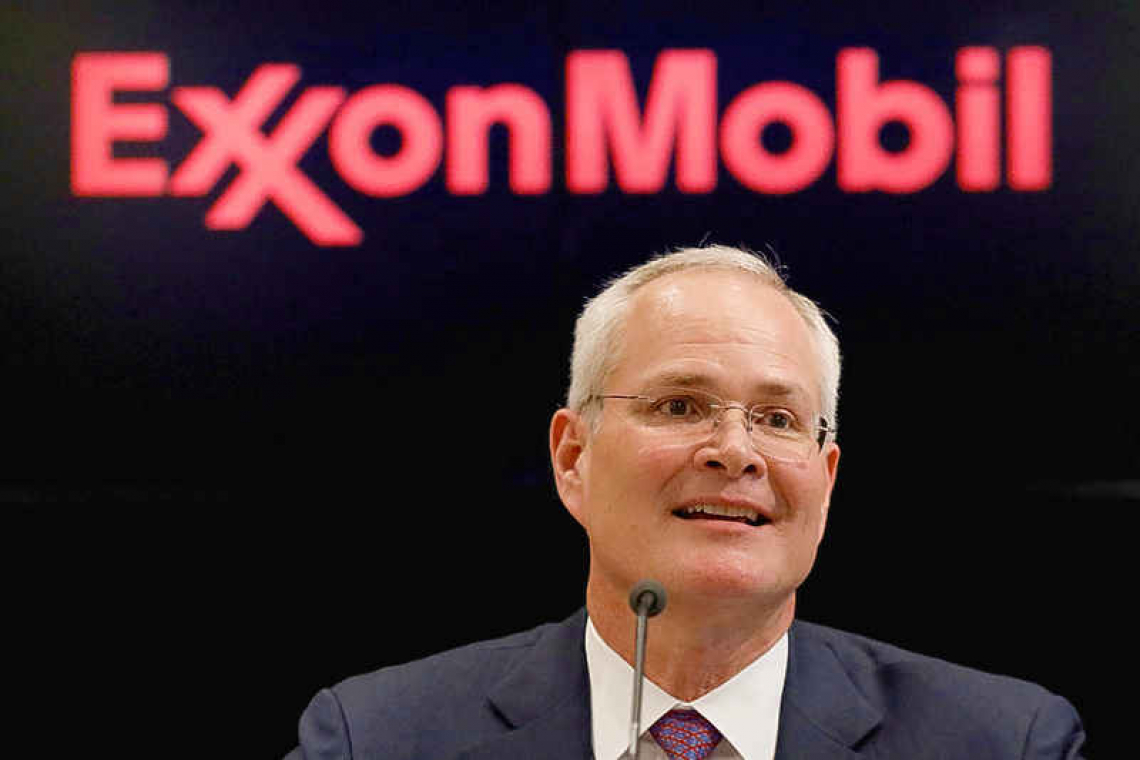

Eight of Exxon's nominees including CEO Darren Woods were re-elected to its 12-member board of directors, along with two of Engine No. 1's nominees, the company said. The counting is not finished, so Engine No. 1 could potentially see three of its four nominees join the Exxon board.

The result will add to pressure on Woods, who campaigned to convince shareholders to shoot down the board challenge and argued the company was already diversifying away from fossil fuels and should not jeopardize its profits in doing so.

Under Woods, Exxon incurred a $22 billion loss last year as COVID-19 pandemic destroyed fuel demand worldwide. Exxon has lagged other oil majors in its response to climate change concerns, forecasting many more years of oil and gas demand growth and doubling down on spending to boost its output - in contrast to global rivals that have scaled back fossil fuel investments.

"It's a huge deal. It shows not just that there is more seriousness apparent in the thinking among investors about climate change, it's a rebuff of the whole attitude of the Exxon board," said Ric Marshall, executive director of ESG Research at MSCI.

The dissident shareholder group led by Engine No. 1 put up a slate of four nominees in the first big boardroom contest at an oil major that makes climate change the central issue. The fund's stake in Exxon - an energy behemoth with a market value of close to $250 billion - is worth just $50 million.

The two Engine No. 1 nominees elected were Gregory Goff, a 64-year-old former top executive at Marathon Petroleum and Andeavor, and former Neste Oyj executive Kaisa Hietala. "We welcome the new directors, Gregory Goff and Kaisa Hietala, to the board and look forward to working with them constructively and collectively on behalf of all shareholders," CEO Woods said at the end of Exxon's shareholder meeting.

Vote counting to determine the final two seats was continuing. That left the re-election of directors Steven Kandarian, Douglas Oberhelman, Samuel Palmisano and Wan Zulkiflee up in the air. Alexander Karsner, one of Engine No. 1's nominees, was still in the running, Exxon said.

Governments and companies have moved to reduce emissions from fossil fuels that are warming the planet by investing in wind and solar energy. Investors led by Engine No. 1 have said Woods needed to make big changes to ensure Exxon's future value to investors.

The fund successfully rallied support from institutional investors and shareholder advisory firms upset with Irving, Texas-based Exxon for its weak financial performance in recent years. Among those were BlackRock Inc, Exxon's second-largest shareholder, who agreed to vote for three members of Engine No. 1's slate.

BlackRock said the three bring "fresh perspectives and relevant transformative energy experience" that would help Exxon evaluate "the risks and opportunities presented by the energy transition," according to a note posted on its website.