The CCI

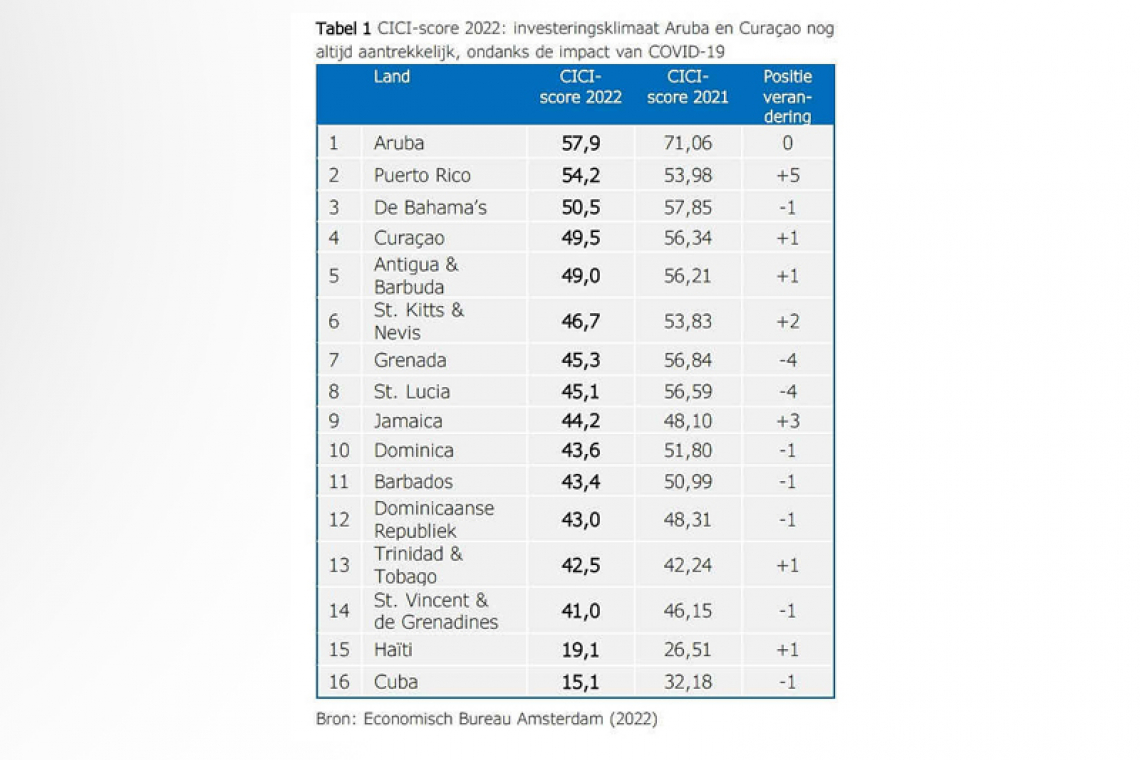

AMSTERDAM--Aruba continues to lead the region as having the most attractive investment climate, but Curaçao also remains high on the ranking, despite both being hit much harder by the COVID-19 crisis than most other islands. The strength of institutions in the Dutch Caribbean plays an important role in this.

In 2021 Economic Bureau Amsterdam (EBA) issued a Caribbean Investment Climate Index (CICI) for the first time. It covered the year 2019, before the coronavirus outbreak.

Public debt percentage of GDP

Negative growth in 2020

A year later, EBA has published a new CICI, which considers the effects of the pandemic on the investment climate. Due to insufficient data availability, the index could not be determined for St. Maarten again this year.

The CICI measures attractiveness of the investment climate of countries in the region. Getting foreign investors is important, because of the small scale of most economies, lack of access to international capital and import-dependency in many cases.

The index contains 16 countries and is made up of e18 institutional, economic and financial indicators. Examples include the rule of law, openness of the economy, economic growth, interest rates, government debt and participation rate.

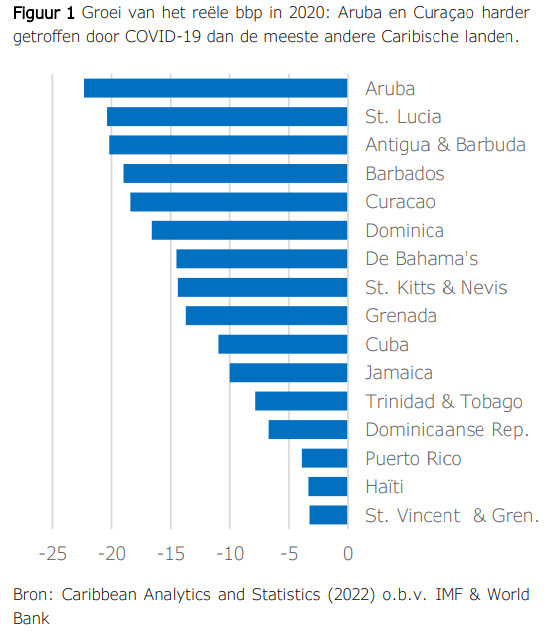

Caribbean territories were hit hard by the corona crisis. Many countries Curaçao, Aruba and St. Maarten rely on tourism, which came to a near complete standstill in 2020.

Of the countries that make up the CICI, the average contraction of real Gross Domestic Product (GDP) in 2020 was 12.8%. By way of comparison: the Dutch economy shrank by 3.8% in 2020.

The CICI 2022 covers 2020 and 2021, and with it the effects of the pandemic. In all countries except Puerto Rico and Trinidad & Tobago, the investment climate has deteriorated as a result.

Aruba still has the most attractive investment climate in the region, despite being impacted by COVID-19 more than other Caribbean countries.

Curaçao’s CICI score also dropped due the pandemic, but its investment is still attractive compared to many other Caribbean countries due to its strong institutions. The island is in fourth place.

The development of the investment climate in 2022 is related to the extent to which countries manage to recover economically from COVID-19. Several of them, including Aruba, showed a strong economic recovery in 2021 resulting from a significant increase in tourism compared to 2020.

However, tourism development remains uncertain in the wake of the pandemic. In addition, there is uncertainty due to rising inflation worldwide and the war in Ukraine.

Interest rates can also pose a serious threat to the investment climate. It is important for Aruba and Curaçao to gradually reduce their high government debt. With rising interest rates, the displacement of productive public investment such as in education and infrastructure will increase, while there is a great need for such in both areas.

In addition, the pace of economic reforms in the context of the so-called “country packages” and implementation agendas will need to be accelerated. In Curaçao, and to a lesser extent in Aruba, there is a large output gap and untapped economic potential.

To turn the tide, the pace of implementation of reforms must be increased. Prioritisation, sequence and coherence of various reforms and measures from the country packages are essential in this respect.

The data availability of Aruba, Curaçao and St. Maarten is limited, in the latter case even too limited to calculate a CICI score. The importance of better data for good policymaking has been emphasised for years. Data is also essential to measure and monitor the effects of the reforms in the context of the country package.